Vietnam Catch-up points with Rule of 70

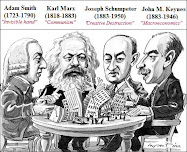

Labels: Economics, Vietnam | author: Robin ThieuCapitalism, Market-oriented Economy & Kinh Tế Thị Trường

Labels: Capitalism, Economics, Quotes, Vietnam | author: Robin Thieu"Cuối thế kỷ XX, kinh tế thị trường chuyển sang mô hình mới là kinh tế thị trường hiện đại. Đây là mô hình dựa trên nền tảng khoa học công nghệ tiên tiến, kết hợp hài hòa giữa bốn yếu tố: thị trường – nhà nước pháp quyền – xã hội dân sự – hội nhập quốc tế sâu rộng. Mục tiêu chung mà nền kinh tế hiện đại hướng đến là sự hưng thịnh của quốc gia, dân tộc, sự giàu có của người dân và sự bình đẳng giữa con người." _ GS-TSKH Lê Du Phong

“Từ góc nhìn vận động của lịch sử, có thể nhận thấy bản chất kinh tế thị trường nhất định đi đến một xã hội tương lai. đó là xã hội mang bản chất nhân văn, xã hội của sự phát triển tự do và toàn diện của cá nhân mỗi người, xã hội phát triển trong quan hệ hài hòa giữa con người với con người và con người với tự nhiên sau một quá trình lịch sử đầy máu và nước mắt” _ GS Trần Ngọc Hiên

1 Year After The Falls - Part III: Spending

Labels: Economics, Finance | author: Robin Thieu- Retail Sales rise 2.7% in August - Sep 15, 2009 | money.cnn.com

- Retail Sales rise beyond expectations - Sep 15, 2009 | cbsnews.com

- Retail Sales increase by largest amount in 3 years - Sep 15, 2009 | blog's carpediem

1 Year After The Falls - Part II: Wealth

Labels: Economics, Finance | author: Robin ThieuSpecial Report: The Crisis - 1 Year Later

...and unique special report, CNBC uncovers the truth behind the crisis all the way back its roots in 2001, and how greed brought the global financial system to its knees...

- US net worth grew in 2Q for first time since '07 - Seattlepi.com | Sep 17, 09

- US economy: home starts, manufacturing index rise - Bloomberg.com | Sep 17, 09

- US household net worth up 3.9% to $53.1 trillion in 2Q - Nasdaq.com | Sep 18, 09

- Bernanke: Recession "likely over" - WSJ.com | Sep 16, 09

1 Year After The Falls - Part I: Banks

Labels: Bank, Finance, finance crisis market | author: Robin ThieuGlobal recession timeline

BBC's full coverage of the anniversary of the global financial meltdown

How did the credit crunch at the end of 2007 become a full financial meltdown by the middle of 2008, and finally turn into a global recession?

This interactive timeline highlights key dates in the financial collapse and helps you find the original reports of the events as they happened.

The Fed’s balance sheet expanded again in the latest week, rising to $2.125 trillion from $2.072 trillion, but the increase came primarily from purchases of mortgage-backed securities, Treasurys and agency debt

Banking Report

Labels: Bank, Economics | author: Robin Thieu"Effective January 2007, FDIC State Profiles have been reformatted as a quarterly data sheet summation of banking and economic conditions in each state..."

- CA:

- Unemployment rate: 11.4% vs. 6.8% (Q2/2008)

- Home price index: -12.6% vs. -17.3% (Q2/2008)

- Nonbusiness Bankruptcy Filings per 1000 people: 5.53 vs. 3.36 (Q2/2008)

- NY:

- Unemployment rate: 8.2% vs. 5.2% (Q2/2008)

- Home price index: -4.1% vs. -1.2% (Q2/2008)

- Nonbusiness Bankruptcy Filings per 1000 people: 3.04 vs. 2.47 (Q2/2008)

Heading of Economics: Gold and Inflation

Labels: Economics, Inflation | author: Robin ThieuGold Jumps to 18-Month High on Weaker Dollar, Inflation Outlook

By: Nicholas Larkin, Halia Pavliva and Kim Kyoungwha

“The market thinks inflation is coming,” Leonard Kaplan, the president of Prospector Asset Management in Evanston, Illinois, said by telephone. He has been trading gold for more than 30 years and believes gold won’t stay above $1,000 for long. “With interest rates so low, money is chasing money and the dollar is getting murdered.”

Governments have cut interest rates and boosted spending to fight the worst recession since World War II, spurring investors to buy bullion as a hedge against the prospect of accelerating inflation and currency debasement. Gold, silver and palladium holdings in exchange-traded funds have reached records.

$1,200 ‘Possible’

Gold may set a record within five sessions and “it’s possible” that it will touch $1,200 within weeks, Prospector’s Kaplan said. “And if a new record doesn’t come soon, it doesn’t come in the near future,” Kaplan said. “Markets think that the Fed isn’t going to withdraw stimulus money fast enough and that would cause inflation.”

Oil Climbs

Crude-oil futures, used by some investors to forecast inflation, surged as much as 5.5 percent today and have soared 59 percent this year in New York.

From: Telegraph

China, Bernanke, and the price of gold

“If they keep printing money to buy bonds it will lead to inflation, and after a year or two the dollar will fall hard. Most of our foreign reserves are in US bonds and this is very difficult to change, so we will diversify incremental reserves into euros, yen, and other currencies,” he said.

From: The Economist

World economyU, V or W for recovery

Aug 20th 2009

The world economy has stopped shrinking. That’s the end of the good newsIT HAS been deep and nasty. But the worst global recession since the 1930s may be over. Led by China, Asia’s emerging economies have revived fastest, with several expanding at annualised rates of more than 10% in the second quarter. A few big rich economies also returned to growth, albeit far more modestly, between April and June. Japan’s output rose at an annualised pace of 3.7%, and both Germany and France notched up annualised growth rates of just over 1%. In America the housing market has shown signs of stabilising, the pace of job losses is slowing and the vast majority of forecasters expect output to expand between July and September. Most economies are still a lot smaller than they were a year ago. On a quarterly basis, though, they are turning the corner.

Giáo dục & Tri thức

Labels: Education, Quotes | author: Robin ThieuMất Ngủ

By: Huy Đức"...Một dân tộc muốn ngửng cao đầu thì trước hết phải biết xấu hổ. Một quốc gia sẽ không có tương lai nếu một nền giáo dục không kiên quyết quay lưng với những điều giả dối. Ngay từ trong nhà trường mà học sinh không biết tư duy độc lập, không có chính kiến thì cho dù có hàng chục nghìn tiến sỹ, đất nước cũng không thực sự có trí thức..."

"...Every single one of you has something you’re good at. Every single one of you has something to offer. And you have a responsibility to yourself to discover what that is. That’s the opportunity an education can provide.And no matter what you want to do with your life – I guarantee that you’ll need an education to do it. You want to be a doctor, or a teacher, or a police officer? You want to be a nurse or an architect, a lawyer or a member of our military? You’re going to need a good education for every single one of those careers. You can’t drop out of school and just drop into a good job. You’ve got to work for it and train for it and learn for it.And this isn’t just important for your own life and your own future. What you make of your education will decide nothing less than the future of this country. What you’re learning in school today will determine whether we as a nation can meet our greatest challenges in the future.You’ll need the knowledge and problem-solving skills you learn in science and math to cure diseases like cancer and AIDS, and to develop new energy technologies and protect our environment. You’ll need the insights and critical thinking skills you gain in history and social studies to fight poverty and homelessness, crime and discrimination, and make our nation more fair and more free. You’ll need the creativity and ingenuity you develop in all your classes to build new companies that will create new jobs and boost our economy.We need every single one of you to develop your talents, skills and intellect so you can help solve our most difficult problems. If you don’t do that – if you quit on school – you’re not just quitting on yourself, you’re quitting on your country.Where you are right now doesn’t have to determine where you’ll end up. No one’s written your destiny for you. Here in America, you write your own destiny. You make your own future..."

Visit msnbc.com for Breaking News, World News, and News about the Economy