Tuesday July 28th 2009

Dropping the shopping

Can America wean itself off consumption? The first of a series on how the world’s four biggest economies must change to ensure sustainable global growth

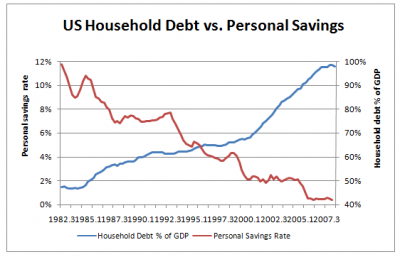

"For decades, its growth has been led by consumer spending. Thanks to rising asset prices and ever easier access to credit, Americans went on a seemingly unstoppable spending binge, fuelling the global economy as they bought ever bigger houses and filled them with ever more stuff. Consumer spending and residential investment rose from 67% of GDP in 1980 to 75% in 2007. The household saving rate fell from 10% of disposable income in 1980 to close to zero in 2007; household indebtedness raced from 67% of disposable income to 132%. As Americans spent more than they produced, the country’s current-account balance went from a surplus of 0.4% of GDP in 1980 to a deficit of almost 6% in 2006..."