Posted by: Peter Coy on July 15

From: BusinessWeek

1. UNEMPLOYMENT: Consumers won’t start shopping again in earnest as long as the unemployment rate is at 9.5% and threatening to break into double digits. People who are out of work can’t spend, and people who fear being out of work won’t spend.

Chart: Econoday

Chart: Econoday

2. SPARE CAPACITY: Companies won’t hire or buy equipment as long as they have lots of slack. Today’s industrial production report revealed that the U.S. industrial capacity utilization rate fell in June to 68%, the lowest since recordkeeping began in 1967. World Bank Chief Economist Justin Lin said today in South Africa that unless global overcapacity is reduced, “we will face a deflationary spiral and the crisis will become protracted,” according to Bloomberg.

Chart: Econoday

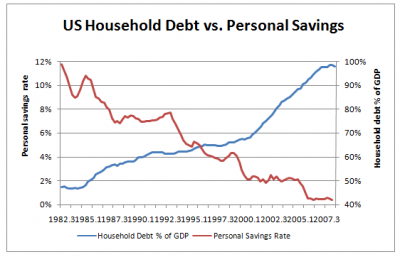

3. DEBT: As I’ve written, household debt soared from two-thirds of GDP in the early 1990s to 100% at the end of 2008. Simply getting debt back to three-quarters of GDP, the level of 2001, would require paying off 25% of all outstanding household debt, $3.5 trillion worth. Paying down debt gets even harder when GDP is falling—that’s Keynes’s paradox of thrift.

Chart: SeekingAlpha

4. BOND VIGILANTES: If fixed-income investors get nervous that the government’s massive deficit spending will push up inflation, they will sell bonds and drive up interest rates. That would be a huge setback for homebuying, car sales, and other rate-sensitive sectors.

Chart: Econoday

5. DOUBLE DIP: Even if the gross domestic product rises in the current July-September quarter—and it might—output could very well fall again in the fourth as the effects of the stimulus tax cuts begin to fade.

Chart: BBC

0 comments:

Post a Comment